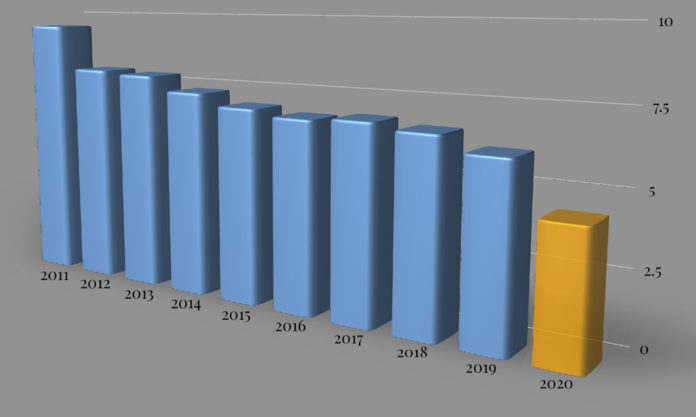

China may be triumphing in her fight of Covid-19, but the resulting shackling of the country’s industrial output is an economic disaster of epic proportions, one that may lead to a 2020 growth in GDP of as little as 4.4 percent.

First the Chinese New Year holiday was lengthened. Then, while firms that could worked from home, so most of China’s factories remained dormant. Not only is the domestic economy set to take a sizeable hit, with China as now the world’s second biggest economy, so there will be a considerable ripple effect elsewhere.

S&P Global Ratings are the ones behind the pessimistic figures. The well-respected American financier’s credit ratings yesterday forecast that China’s growth pace could drop as low as 4.4 percent, if the Covid-19 outbreak does not peak until April as has been suggested, reported the Financial Times.

One of the biggest hit sectors is tourism. With people staying home and airlines canceling their flights to and from China, so demand for oil has dropped dramatically.

- Nanjing Tourist Spots and Scenic Areas Reopen to Public

- Vulcan Mountain Hospital; Ground Zero to Completion in 12 Days

- Quarantine Arrangements for Flights Arriving in Nanjing

“Global oil demand has been hit hard by the novel coronavirus (Covid-19) and the widespread shutdown of China’s economy. Demand is now expected to fall by 435,000 barrels year on year in the first quarter of 2020, the first quarterly contraction in more than 10 years”, the International Energy Agency said in its latest monthly report.

China is the world’s biggest importer of oil.

Meanwhile, revenues for the airline industry globally could be down by as much as US$4-5 billion in the first quarter of 2020, said a report from the UN’s International Civil Aviation Organisation (ICAO).

Needless to say, the pool that is Chinese tourists travelling abroad has all but completely dried up. Two of the most popular destinations are nearby Japan and Thailand. The ICAO forecasts that Japan’s tourism revenue could drop by US$1.29 billion in the first quarter of 2020, while that for Thailand might be US$1.15 billion.

- An Infected Person is Nearby; Big Data/Your Phone to the Rescue!

- Wuhan Volunteer Driver’s Video Diary Clocks up 31 Million Views

- Nanjing Reports Zero New Cases; 1,000+ Cured Each Day Nationally

Elsewhere, global manufacturing is taking a hit. Apple will be struggling to fulfil orders for iPhones, as Foxconn, its manufacturing partner in China, is facing production delays. In the auto sector, Nissan and Hyundai are experiencing difficulties in obtaining parts from China and as a result have temporarily closed factories abroad, reported the World Economic Forum.

Finally, there is human nature itself, in the form of anxiety-induced reluctance to spend. As the main threat to prosperity in an economic downturn, so the Chinese people are laying off the purchase of big-ticket items. They are opting instead for hygiene-related products and the basics of living.

As a result, Chinese financial institutions have cut their benchmark lending rate in hope that it can be a shot in the arm for the economy. It was announced yesterday that the 1-year-loan prime rate was being reduced by 0.1 percentage points to 4.05 percent.

Back on 12 February, Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, forecast a quick recovery for China’s GDP, as factories try to make up for lost time. “The most likely scenario we now view is a V-shaped impact. In other words, sharp decline in economic activities in China, followed by a rapid recovery and a total impact on China relatively contained”, she said.

Whether there will still be the jobs to pay for that recovery remains altogether a question for another day.